| Updated on | Metal | Currency | Price |

|---|---|---|---|

| 01-01-1970 05:30 | Palladinum |

| 24 Karat | |

|---|---|

| NO GST: | ₹ 0 0 |

| 3% GST: | ₹ 0 0 |

| 3% GST + 1% Making: | ₹ 0 |

| 3% GST + 2% Making: | ₹ 0 |

| 3% GST + 3% Making: | ₹ 0 |

| 3% GST + 4% Making: | ₹ 0 |

| 3% GST + 5% Making: | ₹ 0 |

| 3% GST + 6% Making: | ₹ 0 |

| 3% GST + 6.8% Making: | ₹ 0 |

| 3% GST + 7% Making: | ₹ 0 |

| 22 Karat | |

|---|---|

| NO GST: | ₹ 0 0 |

| 3% GST: | ₹ 0 0 |

| 3% GST + 1% Making: | ₹ 0 |

| 3% GST + 2% Making: | ₹ 0 |

| 3% GST + 3% Making: | ₹ 0 |

| 3% GST + 4% Making: | ₹ 0 |

| 3% GST + 5% Making: | ₹ 0 |

| 3% GST + 6% Making: | ₹ 0 |

| 3% GST + 6.8% Making: | ₹ 0 |

| 3% GST + 7% Making: | ₹ 0 |

| 18 Karat | |

|---|---|

| NO GST: | ₹ 0 0 |

| 3% GST: | ₹ 0 0 |

| 3% GST + 1% Making: | ₹ 0 |

| 3% GST + 2% Making: | ₹ 0 |

| 3% GST + 3% Making: | ₹ 0 |

| 3% GST + 4% Making: | ₹ 0 |

| 3% GST + 5% Making: | ₹ 0 |

| 3% GST + 6% Making: | ₹ 0 |

| 3% GST + 6.8% Making: | ₹ 0 |

| 3% GST + 7% Making: | ₹ 0 |

| 24 Karat | |

|---|---|

| NO GST: | ₹ 0 |

| 3% GST: | ₹ 0 |

| 3% GST + 1% Making: | ₹ 0 |

| 3% GST + 2% Making: | ₹ 0 |

| 3% GST + 3% Making: | ₹ 0 |

| 3% GST + 4% Making: | ₹ 0 |

| 3% GST + 5% Making: | ₹ 0 |

| 3% GST + 6% Making: | ₹ 0 |

| 3% GST + 6.8% Making: | ₹ 0 |

| 3% GST + 7% Making: | ₹ 0 |

| 22 Karat | |

|---|---|

| NO GST: | ₹ 0 |

| 3% GST: | ₹ 0 |

| 3% GST + 1% Making: | ₹ 0 |

| 3% GST + 2% Making: | ₹ 0 |

| 3% GST + 3% Making: | ₹ 0 |

| 3% GST + 4% Making: | ₹ 0 |

| 3% GST + 5% Making: | ₹ 0 |

| 3% GST + 6% Making: | ₹ 0 |

| 3% GST + 6.8% Making: | ₹ 0 |

| 3% GST + 7% Making: | ₹ 0 |

| 18 Karat | |

|---|---|

| NO GST: | ₹ 0 |

| 3% GST: | ₹ 0 |

| 3% GST + 1% Making: | ₹ 0 |

| 3% GST + 2% Making: | ₹ 0 |

| 3% GST + 3% Making: | ₹ 0 |

| 3% GST + 4% Making: | ₹ 0 |

| 3% GST + 5% Making: | ₹ 0 |

| 3% GST + 6% Making: | ₹ 0 |

| 3% GST + 6.8% Making: | ₹ 0 |

| 3% GST + 7% Making: | ₹ 0 |

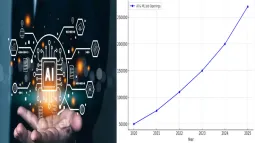

About Gold Price In India

'Making Charges' on gold making can vary between 3% to 25% of the precious metal's worth, depending on the design and jeweler.

Factors that determine making charges

Design complexity:The complicated designs attract higher making charges, while simple designs charge lower.

Materials:Items made from more precious stones or pearls have a higher making charge than simple, plain gold jewelry.

Per-gram or percentMaking charges can be charged per gram or as a percentage of the value of the gold.

How making charges are calculated

- Per-gram: The charge depends on the jeweler taking a fixed amount per gram of gold

- Percentage: The charge is a percentage of the value of gold

- Combination: The charge in percentages of the value of gold and then the charge per gram of gold

Other charges

- Wastage charges: The jeweler charges the wastage of gold which incurs during the production process.

- GST: The jeweler takes GST on the total amount

Gold price comparison to US

The gold price in the US is more expensive as compared to the price in India. The dollar strength, monetary policy, interest rates, etc are some factors that affect the gold price in the US.

Price variations

- Price per gram: The US gold price is higher than India.

- Price per ounce: The US gold price is higher than India.

Price variation factors

- Dollar strength: The US dollar is one of the leading currencies in the world, making gold more costly for foreign buyers.

- Interest rates: Interest rates can influence the price of gold.

- Monetary policy: Monetary policy can affect the price of gold.

- Elections: Elections can influence the price of gold.

- War conditions: War conditions can influence the price of gold.

Gold reserves

The US has almost 10 times the amount of gold reserves as India.

Gold ornaments

Indian online jewelers in the US:

Indian jewelers have designs available from all parts of India.

Indian jewelers are great at showcasing the local designs of each region.

GST Rate on Gold 2024

A tax of 3% GST or 1.5% of CGST along with 1.5% of SGST was levied on gold while an additional tax of 8% was applicable on making charges. Later the tax on the making charge came down to 5% with objections raised from various quarters.