Google Pay Introduces Convenience Fees on Card Transactions

Google Pay, the most popular digital payments app, has started charging a convenience fee for bill payments made with credit and debit cards. It was not being charged earlier when people used to pay bills such as electricity and gas. But the app has started charging a minimal transaction fee on card payments now. UPI payments are cost-free.

This move aligns Google Pay with other payment platforms like Paytm and PhonePe, which already levy such charges.

Convenience Fees on Bill Payments

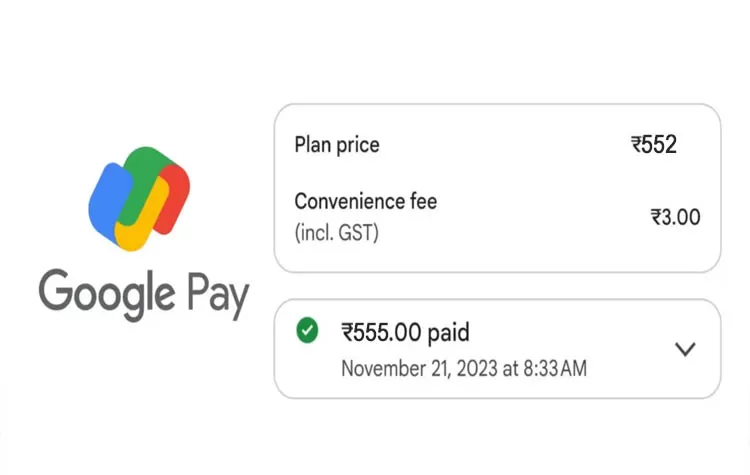

Ever since last year, Google Pay has been charging a Rs. 3 convenience charge for recharges done via mobile. There are now reports that 0.5% to 1% is being charged on the payment of electricity and gas bills through credit/debit cards.

A recent instance was that of a user who was reported by an English media channel. The user had paid their electricity bill via a credit card on Google Pay and was charged a Rs. 15 convenience fee. This indicates that the new fees are already in effect.

Who will be affected by these Charges?

It is not clear yet if the fees will be charged on all users or specific transactions. Tech sector analysts expect the fees to be charged on all Google Pay users in the near future.

Currently, Google Pay has not issued any formal statement regarding these changes. However, according to Google Pay's website, the fee is utilized to pay the card payment handling fees.

Industry Trends and Future Impacts

The platform fee charging is increasingly becoming the norm for fintech, quick commerce, and food delivery firms. Various firms are charging equivalent fees to drive revenues and balance operating expenses. Market experts believe that other online payment systems will also implement these charges in the future, and free online transactions will be a rare phenomenon.

Tags Cloud